Discover how funds are earning operational alpha by solving for front-office workflow inefficiencies.

IntroductionWhat Is Operational Alpha?Why Workflows Matter3 Cs of Investment WorkflowsAnalyst Research WorkflowsCompliance WorkflowsPortfolio Monitoring WorkflowsBottom Line

AUM keeps rising. But margins are shrinking.

While pursuing alpha is the main prerogative of investment research teams, many hedge funds and mutual funds are wringing waste out of their research process by looking at how teams drive ideas through the pipeline and into the portfolio.

In this article, we’ll cover how hedge funds and mutual funds are tackling inefficiency by optimizing their mutual fund or hedge fund workflows, the benefits of which are termed “operational alpha.”

Operational alpha is the bottom-line savings achieved by improving fund efficiency, processes, and workflows.

Operational alpha is value generated by the firm outside of a fund’s portfolio. Operational alpha is becoming an important concept as funds grow in size and complexity.

A smooth, strong fund workflow can improve operational performance & efficiency, reduce the need for compliance to interfere, help teams learn from success & failure, and ultimately, get the best ideas into the portfolio sooner.

(Video) The Palantir Demo Day Full Videos (Gotham, Foundry, Apollo)

Execution is everything. The right tools make a meaningful difference.

As the Hedge Fund Journal puts it:

The brilliance of the market strategy and the execution skill of the analyst won’t make any difference if the quality of the data inputs and the execution tools aren’t up to scratch. Indeed, a suitable analogy would be employing a master carpenter to build one’s home whilst only allowing him access to poor quality tools.

Performance: Front-office workflows can be overlooked by some funds. But with process efficiency and automation, teams can nearly eliminate the drag created by jumping around between tools and platforms and focus on what they are rewarded for: driving alpha.

Compliance: Whether the need for heightened cybersecurity or the looming threat of an SEC audit, many funds are finding that compliance safeguards and workflows can reduce disruptions and streamline reporting.

Confidence: How quickly are ideas moving into the portfolio? Are you learning from successes and failures? Good workflows bring confidence to funds by helping them do more of what’s working.

Related Content:

The best workflow will be the one that works best for your team. At Verity, we categorize research workflows using the following framework.

When we pay attention to front-office teams and how they participate in the process of pushing ideas through this pipeline, we can uncover where issues may be and how to best resolve them.

From idea generation to compliance and monitoring, here are some examples of typical fund workflows and customizations prized by customers of Verity’s research management system.

If you want to accelerate and/or scale a workflow, you need to reduce the processing power required to create and digest the information in the first place.

If, as an analyst, you need to start from scratch every time you are putting together your analysis, then you also have to make adjacent decisions about format, priority, and structure of information. It slows you down. If, as a portfolio manager, you are receiving recommendations, briefings, and more in a variety of formats, it stalls your ability to see the signal from the noise.

The best way to combat this workflow inefficiency is to standardize the information that’s getting shared, and create a sense of cohesion with the investment process.

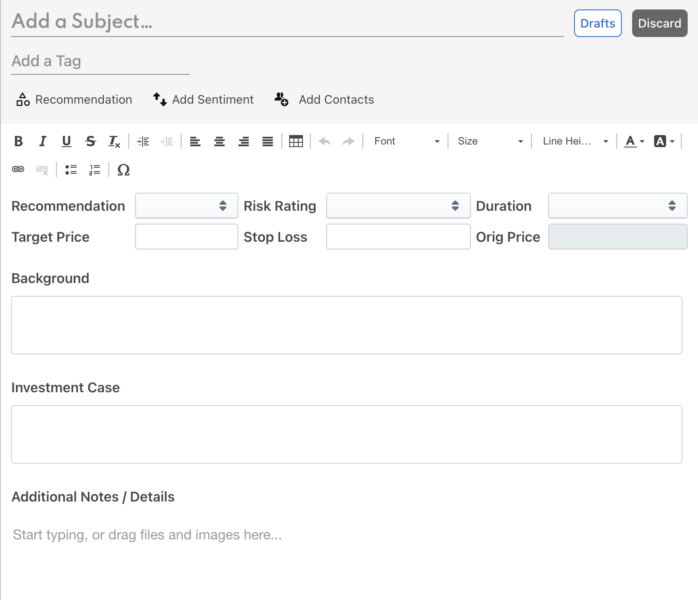

VerityRMS customers take advantage of the out-of-the-box and customizable note templates available. They often require analysts to provide essential information for investments (such as target prices, thesis, upcoming catalysts, ESG indicators, etc.) or calls with expert networks (such as the name of the provider, compliance approval, or point value of call).

With templates, analysts don’t have to reinvent the wheel. PMs can review notes with a high signal-to-noise ratio.

(Video) Reid Hoffman: Decision Making, Scaling Companies, & Leading Through Crises | TKP 147

What triggers are analysts monitoring? How many different places do they have to go to get them?

One way to optimize a workflow is to consolidate the inputs, put the important information in one place. Not only good for saving time, this adds a layer of context that can help analysts make connections quicker than they have before.

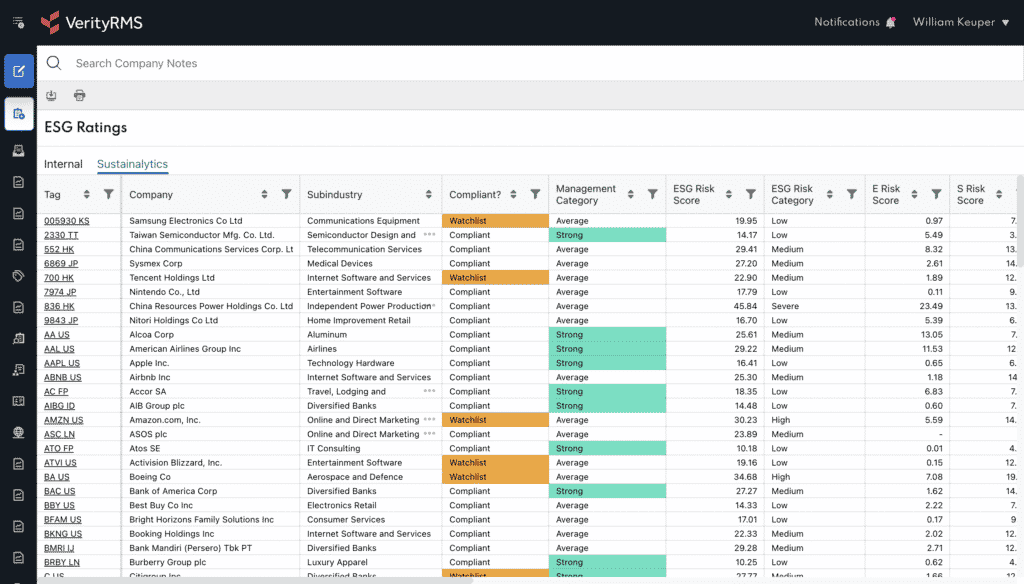

You may want to pull in ESG data via Sustainalytics, insider activity data via VerityData, or another 3rd party data provider.

Funds are consolidating data inputs, like ESG ratings, to reduce analyst legwork.

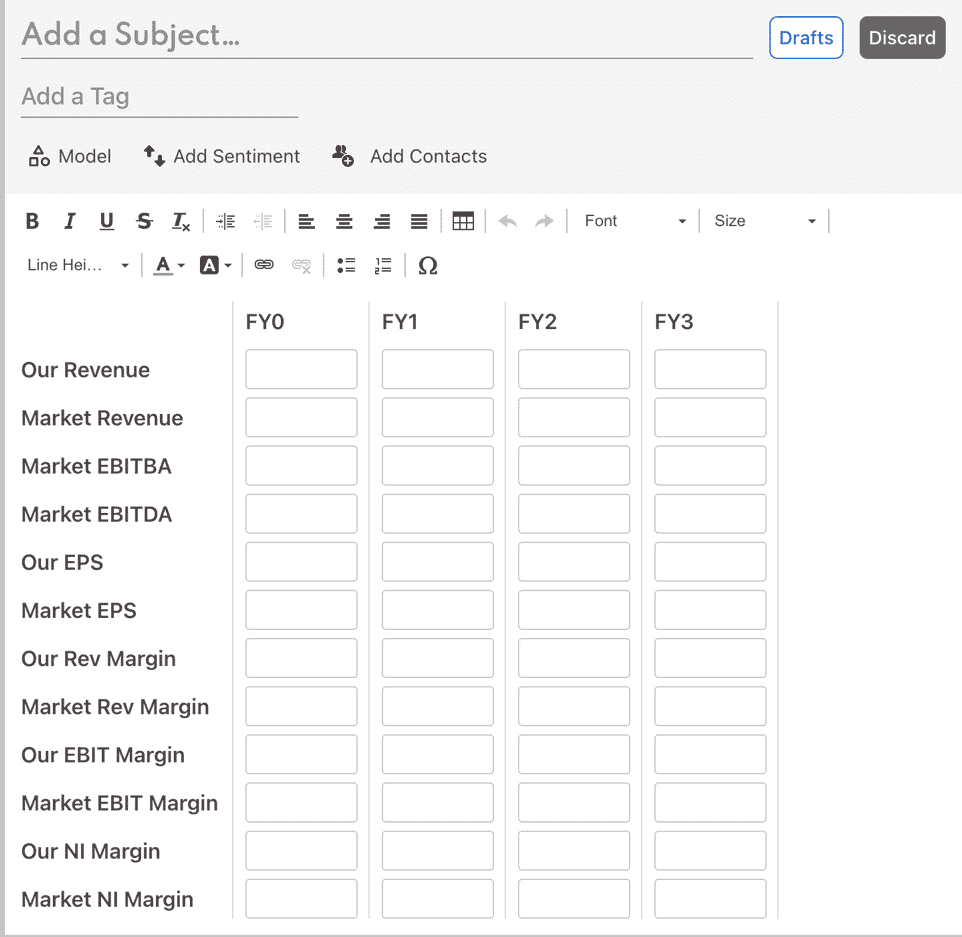

When you update a model, is it syncing with other data properly? Is it going everywhere it needs to go? Is data across analysts models easily consumable in one place?

Many hedge funds use the VerityRMS Excel integration to ensure all of the above.

The RMS add-in sits on-top your team’s proprietary model structure, ingesting the fields you care about. Without ever leaving Excel, estimates, price targets and more can be fed to the RMS, creating custom views for portfolio managers, more effectively tracking model data over time.

Compliance tasks, though necessary, typically disrupt an analyst’s workday. At the same time, compliance officers must track down the information they need, which may be spotty in the first place.

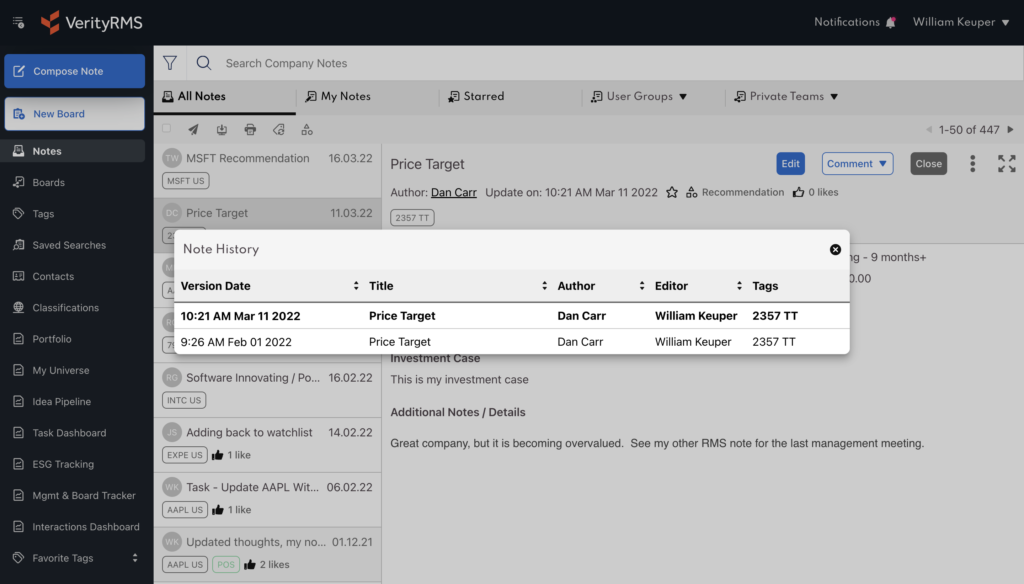

Some hedge funds are proactive about enforcing compliance protocols. For example, they set a limit on what can be downloaded from the RMS. Others simply wish to monitor if many notes are downloaded at once; or view the iteration history of a note.

Example VerityRMS note history shows all versions of a recommendation.

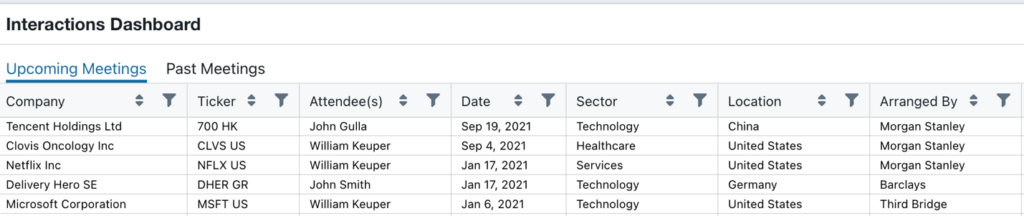

Tracking expert network calls is another compliance-related workflow optimization. If you use a structured note template to capture details of the call (broker, rating, compliance questionnaire, etc.), then the RMS can pull the note and its metadata (date, author, tag/ticker, company) into a dashboard, as shown below, that can confirm compliance questions were answered prior to the expert call.

(Video) You Can Be A VC investor | The Warren Buffett Approach w/ Kiyan Zandiyeh (TIP469)

By tracking expert network calls, fund have compliance benefits, but can also determine which brokers must be paid.

Perhaps most importantly, with VerityRMS compliance officers will have full access and audit insights into the entire investment story. All content, data and notes that went into an investment decision is automatically organized and only a click or two away – without having to bother the investment team.

Another common use case for a fund workflow is to use the RMS as a portfolio management tool.

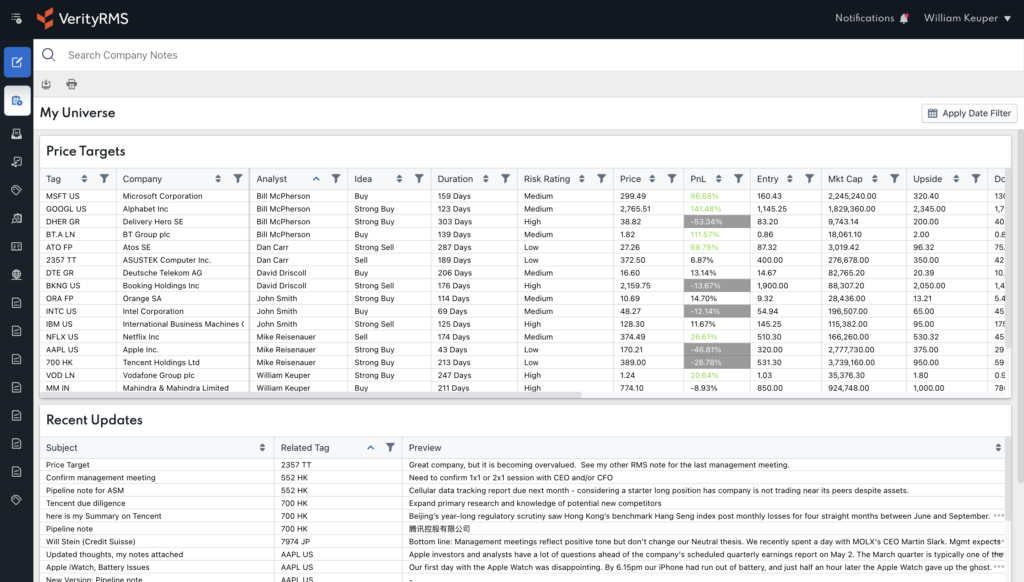

Recommendations from analysts can populate a dashboard tracking active and passed ideas, price targets, theses and more.

In VerityRMS, these fields are entirely customizable, and can be integrated with your holdings and/or PMS system. You can get market data from Refinitiv, or any other third-party, for actionable, performant, and market-driven workflows within the RMS. Many investors create custom landing pages so the RMS does the work for them.

One of an infinite number of possible dashboards . PMs can also integrate an internal or 3rd party portfolio tool with the No-Code Toolkit.

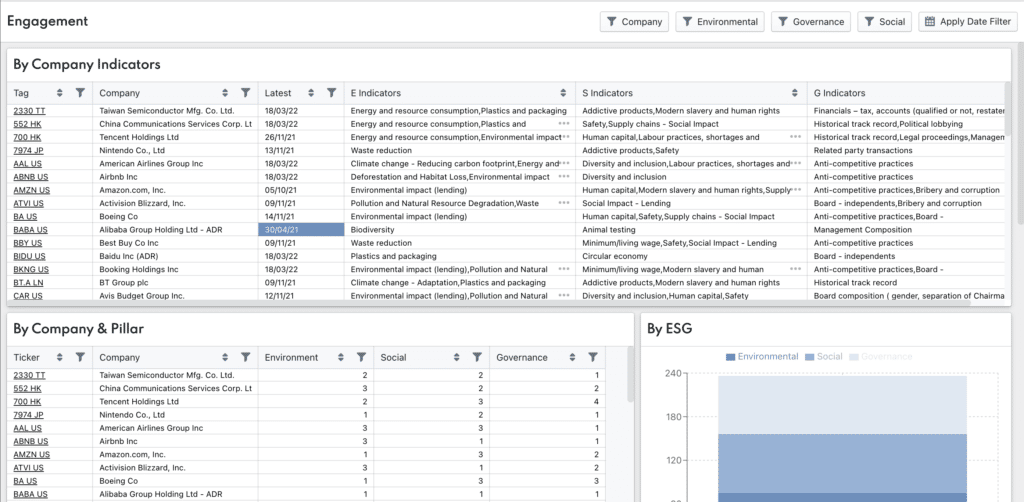

More and more firms are integrating ESG processes into the RMS. Impact investing and engagement tracking, for example, are essential to many asset manager mandates. But creating insights and reporting can be difficult.

Many funds use VerityRMS to streamline ESG issue tracking, engagement, and impact processes. The result has positive impacts on portfolio management, investor queries, and regulatory requirements.

How integrated is ESG nto your research process? Many funds track things like engagement (above) to optimize efficiency.

Hopefully, these examples provided transparency into how hedge funds are improving their front-office workflows and driving operational alpha.

As mentioned, the best workflow is the one that works for your team. At Verity, we work with funds all over the world, making sure to keep what sets you apart stays intact. At the same time, we can introduce workflow efficiencies that are nearly universal across firms.

Could VerityRMS Bring Value to Your Fund?

Discover how you canaccelerate winning investment decisions with better intelligence, a leaner workflow, and quicker confidence >>

(Video) What Stops Investors from doing Securities Lending?

Related Resources

BlogData Overload: How Funds Counter Underutilization With a Modern RMSWhen data becomes too much of a good thing, an RMS built on the foundation of a relational database can be the answer. BlogWhat to Expect From the 1% Buyback TaxWill the new 1% buyback tax impact buyback spending? Unlikely. Here’s what we expect to see for the remainder of the year. BlogThe Insider Review | August 2022A monthly summary of notable insider trading activities from Verity’s Director of Research.

See how Verity accelerates winning investment decisions for the world’s leading asset managers.

Request a Demo

(Video) Google Cloud Security Summit

The fund’s alpha is calculated as: Alpha = 15% – (3% + 1.2 x (12% – 3%)) = 15% – 13.8% = 1.2%. With a beta of 1.2, the mutual fund is expected to be riskier than the S&P 500 index, and thus earn more.

Do hedge funds deliver alpha? ›

Our results indicate that, with hedge funds, the spread portfolio alpha increases by sixteen-fold with Bayesian alpha—versus OLS alpha—based sorts, suggesting that Bayesian methods are even more powerful in hedge fund studies given the severity of the short sample problem.

What is hedge fund alpha? ›

Alpha is the excess return on an investment after adjusting for market-related volatility and random fluctuations. Alpha is one of the five major risk management indicators for mutual funds, stocks, and bonds.

What is operational alpha? ›

Operational Alpha™ is gaining traction as a measure to gauge. operational efficiency. Originally applied to asset managers seeking. ways to generate investment alpha through improved data management, Operational Alpha™ relates equally well to asset owners seeking higher.

How much alpha do hedge funds generate? ›

We found that, on average, the average annualised alpha per equity long/short hedge fund is 8.8% and the average annualised alternative beta premium per equity long/short hedge fund is 5.0%.

How do you measure alpha? ›

Alpha = R – Rf – beta (Rm-Rf)

R represents the portfolio return. Rf represents the risk-free rate of return. Beta represents the systematic risk of a portfolio. Rm represents the market return, per a benchmark.

What does alpha mean in finance? ›

Alpha and beta are two of the key measurements used to evaluate the performance of a stock, a fund, or an investment portfolio. Alpha measures the amount that the investment has returned in comparison to the market index or other broad benchmark that it is compared against.

What is a good alpha value? ›

The alpha value, or the threshold for statistical significance, is arbitrary – which value you use depends on your field of study. In most cases, researchers use an alpha of 0.05, which means that there is a less than 5% chance that the data being tested could have occurred under the null hypothesis.

What is the difference between alpha and beta? ›

Alpha Testing is a type of software testing performed to identify bugs before releasing the product to real users or to the public. Alpha Testing is one of the user acceptance tests. Beta Testing is performed by real users of the software application in a real environment.

What does a negative alpha mean? ›

Alpha is an important tool for many investors when trying to figure out if their investments are doing well. A positive alpha indicates the security is outperforming the market. Conversely, a negative alpha indicates the security fails to generate returns at the same rate as the broader sector.

How do hedge funds calculate returns? ›

Simple hedge fund returns

Take the ending balance of your hedge fund account before it imposes its fees and divide it by the balance that you had at the beginning of the period. Subtract 1 and then multiply by 100, and the result gives you your percentage gross return from your hedge fund investment.

What is weighted alpha? ›

Weighted alpha measures the performance of a security over a certain period, usually a year, with more importance given to recent activity. A positive weighted alpha shows that the security produced a return greater than the benchmark; a negative measure indicates the converse.

What does alpha mean in CAPM? ›

Mathematically speaking, alpha is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model (CAPM). To understand how it works, consider the CAPM formula: r = Rf + beta * (Rm – Rf ) + alpha. where: r = the security’s or portfolio’s return.

What is alpha beta and Sharpe ratio? ›

Higher the beta, lower is the alpha and vice versa. The standard Deviation measures the riskiness of the fund. Higher the SD, higher is the volatility of the fund. Sharpe ratio measures the unit of return earned for every unit of risk undertaken. Higher the Sharpe ratio, better is the fund.

What is alpha and beta in portfolio management? ›

Unlike beta, which simply measures volatility, alpha measures a portfolio manager’s ability to outperform a market index. Alpha is a measure of the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta.

What is a good Sharpe ratio? ›

Usually, any Sharpe ratio greater than 1.0 is considered acceptable to good by investors.

Videos

1. Final Cut Pro 10.4.9 – What’s new? 2. Google Cloud For Hedgefunds 3. Tackling the digital transformation: winning strategies for asset management firms (IMpower Incorporating FundForum) 4. Will Cook – Sunriver Management (Manager Meetings, EP.22) (Capital Allocators with Ted Seides) 5. 2019 MIT Citi – 5 – Startup Lightning Talks Parts I & II (MIT Corporate Relations) 6. ExcelsiusGPS® Case Workflow Case 1

Top Articles

You might also like

Latest Posts

Author: Eusebia Nader

Last Updated: 08/09/2022

Views: 6302

Rating: 5 / 5 (80 voted)

Reviews: 95% of readers found this page helpful

Name: Eusebia Nader

Birthday: 1994-11-11

Address: Apt. 721 977 Ebert Meadows, Jereville, GA 73618-6603

Phone: +2316203969400

Job: International Farming Consultant

Hobby: Reading, Photography, Shooting, Singing, Magic, Kayaking, Mushroom hunting

Introduction: My name is Eusebia Nader, I am a encouraging, brainy, lively, nice, famous, healthy, clever person who loves writing and wants to share my knowledge and understanding with you.

© 2022 Soviti. All Rights Reserved.